Board approves higher district levy for 2006

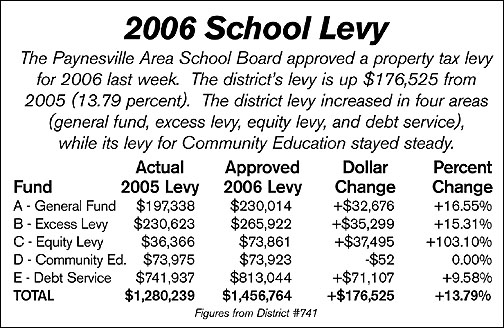

This year (2005), the district levied $1.28 million, while next year (2006) the district will levy $1.46 million.

The district levy, which was the subject of a truth-in-taxation hearing earlier in December, is the maximum allowed and is the same as the proposal approved by the school board this fall.

It is the highest levy for the district since 2001, when it levied $2.23 million. Starting in 2002, the state assumed funding for much of the property tax levies of schools, and the district levy dropped under $1 million that year.

District residents then approved a $415-per-pupil levy in April 2002, raising the district's levy to $1.4 million in 2003.

In 2004, the levy dropped back to $1.25 million, and in 2005 it increased slightly to $1.28 million.

In 2004, the levy dropped back to $1.25 million, and in 2005 it increased slightly to $1.28 million.

The district levy increased in four areas in 2006: general fund (up $32,676), excess levy (up $35,299), equity levy (up $37,495), and debt service (up $71,107). The levy for Community Education is down $52.

The local excess levy and equity levy - both related to the $415-per-pupil levy - increased due to a decrease in state aid. The excess levy totalled $496,970 in 2005, of which the local share was $230,623 (about 46 percent). The local share of the equity levy was also about 46 percent in 2005.

In 2006, the local share has risen to 54 percent. So, for the excess levy, which will generate $491,788 in 2006 (down $5,000), the local share has increased $35,299. (See Line B in the chart.)

In addition to paying a higher share of the equity levy, equity revenue for the local district increased by $56,000 in 2006, resulting in a total increase in the equity levy for local taxpayers of $37,495 in 2006. (See Line C in the chart.)

In the general fund, the local levy increased by $32,676, most of which was due to an increase in the capital levy - for building maintenance and other capital purchases - of $31,479 ($138,428 in 2005 and $169,908 in 2006). (See Line A in the chart.)

Finally, in debt service, the local levy increased by $71,107 in 2006. This is not due to increased spending by the district, but rather a lowering of the tax rate due to a surplus in the district's debt service fund (an unreserved balance of $242,749, as of July 2005, according to the recent district audit).

While the district's debt service payments still total around $850,000 per year, due to that fund balance, the district's debt service levy was reduced by $112,517 in 2005 (to lower the fund balance). In 2006, the debt service levy was only reduced by $41,631 (due to a smaller fund balance). (See Line E in the chart.)

The school district has a total budget of $10 million for 2005-06, of which $8.5 million represents expenditures in the general fund.

The property tax levy - determined by a formula from the state (32 pages in 2006, up from 26 pages in 2005) - can be downloaded and reviewed in detail from the Department of Education's website at education.state.mn.us.

Contact the author at editor@paynesvillepress.com • Return to News Menu

Home | Marketplace | Community