City approves budget,

tax levy increases for 2007

The Paynesville City Council passed its 2007 budget and tax levy at its regular meeting on Wednesday, Dec. 13.

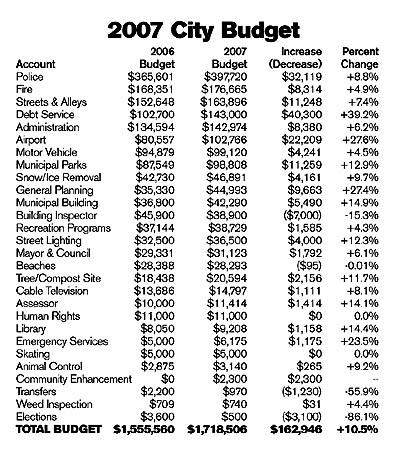

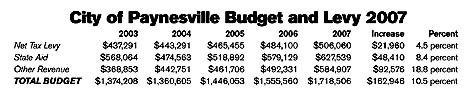

The budget calls for $1,718,506 in total spending for the 2007 fiscal year (which mirrors the calendar year, running from January to December). This is an increase in spending of $162,946 (10.5 percent) from 2006, when the city's total budget was $1,555,560.

The budget calls for $1,718,506 in total spending for the 2007 fiscal year (which mirrors the calendar year, running from January to December). This is an increase in spending of $162,946 (10.5 percent) from 2006, when the city's total budget was $1,555,560.

The city's tax levy increased by $21,960, from $484,100 in 2006 to $506,060 in 2007, or 4.5 percent.

In order to increase spending by 10.5 percent while limiting its tax levy to a 4.5-percent increase, the city expects a $48,410 increase (8.4 percent) in its Local Government Aid, up to $627,539 for 2007. The city also expects other revenue to increase by $92,576 (18.8 percent) to $584,907. This includes revenue for public safety ($149,600), motor vehicle ($110,400), airport ($70,000), and a property tax credit of $68,500

Increased spending ($162,946) includes: $40,300 for additional bond payments (due to the street project this summer), up 39 percent; $34,200 for additional transfers for capital purchases (including an additional $12,000 for parks, $6,000 for street equipment, $5,000 for city hall, $4,000 for the airport, $3,000 for street construction, and $1,000 for cable access), up 27 percent; $18,100 for professional services (including $12,000 in additional legal services), up 30 percent; $15,900 for salaries, up 2.8 percent; $14,500 for fuel, up 32 percent; and $13,500 for engineering, including $9,000 for general planning, which was new to the budget.

By department, the additional spending was budgeted mainly for: debt service (up $40,300); police (up $32,100); parks (up $11,300); streets and alleys (up $11,200); and general planning (up $9,000 for that planned engineering expense).

While budgeting, the city reviews its 2006 budget plus its actual expenditures so far in 2006. The council approved a preliminary budget and tax levy in September, then reviewed the budget this fall, and approved the final budget and tax levy last week.

Sewer and Water Rates

In addition to its budget and levy, the city council approved new sewer and water rates for 2007 last week.

The water fund has a budget for 2007 of $400,648 (up 4.2 percent), while the sewer fund has a budget of $566,755 (up 4.1 percent).

Quarterly flat rates for water were increased to $14.50 (from $13.63) with bulk rates (per 1,000 gallons) all going up 10¢. For a residence using 17,000 gallons of water per quarter, this would translate into a quarterly increase of $2.39. For an industry using 500,000 gallons of water per quarter, this would translate into an increase of $50.69 per quarter.

With these new rates, the water fund is expected to generate $402,180 in revenue in 2007.

Sewer rates were raised only slightly in 2007. The quarterly flat rate was raised 2¢ (from $15.98 to $16.00) for 2007 with the bulk rate kept at $1.99 per 1,000 gallons.

With this modest increase, sewer fund revenues are expected to produce $577,108 in 2007.

The water fund has a cash balance (as of October 2006) of $354,900 with another $116,100 in its equipment replacement fund and $261,000 in its capital improvement fund. The sewer fund has a cash balance (as of October 2006) of $245,700 with another $218,400 in its equipment replacement fund and $332,000 in its capital improvement fund.

Contact the author at editor@paynesvillepress.com • Return to News Menu

Home | Marketplace | Community