Audit confirms District #741 is

in statutory operating debt

Paynesville Area School District's dwindling general fund account was confirmed last week with the completion of the district's annual audit for the 2000-01 school year.

Paynesville Area School District's dwindling general fund account was confirmed last week with the completion of the district's annual audit for the 2000-01 school year. Al Habben of Frieler, Habben, and Company presented the audit to the school board at their meeting on Tuesday, Oct. 23.

The district still had a positive balance in its general fund ($57,081) as of June 30, 2001, the last day of the 2000-01 school year. This balance is the result of remaining reserved dollars for things like staff development and compensatory revenue. In unreserved funds, the general fund is in deficit by $243,000, which qualifies the district for statutory operating debt, as defined by the state.

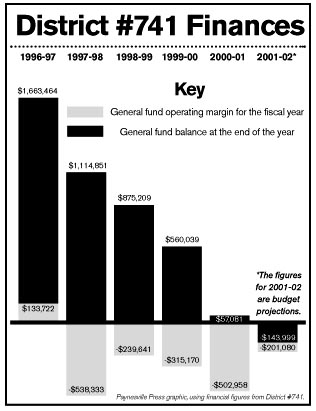

The audit revealed an operating deficit of $503,000 in the general fund for 2000-01, which reduced the the general fund balance from $560,000 in June 2000 to $57,000 in June 2001. The school district has now operated in deficit for four consecutive years, which has reduced the district's general fund balance from $1,663,000 at the end of the 1996-97 school year to $57,000 at the end of the 2000-01 school year.

The district's budget for the 2001-02 school year - even after the district made $500,000 in budget reductions that took effect this fall - still projects a general fund deficit of $200,000. In order to get out of statutory operating debt, the district would need to balance its budget and rebuild its general fund.

Superintendent Howard Caldwell had warned the board for several months that the district would likely qualify for statutory operating debt, and the audit confirmed his warning. Statutory operating debt status means the school district will have to present a written plan to the state about how the district will get out of debt by the end of January.

Caldwell has said the only ways to balance the budget are to get more revenue or to make more budget reductions. He will not start on the written plan until the fate of the $315 per pupil unit excess levy referendum on Tuesday, Nov. 6, is known. The excess levy would provide the district with $473,000 in extra revenue in 2002-03, according to the latest district information. This would help to balance the district's budget and make any cuts less severe, said Caldwell.

The district will need to cut around $150,000 from its budget for next year, whether the excess levy passes or not, according to Caldwell, to offset the revenue loss from declining enrollment. Paynesville Area High School will graduate 120 seniors next spring, but recent kindergarten classes at Paynesville Area Elementary School have averaged only 79 students over the past four years, indicating a potential drop of 40 students next fall.

The district did have fund balances of $181,000 in its special revenue fund (including community education and food service), $188,000 in its debt service fund, and $319,000 in its building construction fund, which along with its general fund totaled $745,000 as of June 30, 2001. The special revenue fund increased by $6,000 in 2000-01 and the debt service fund decreased by $81,000.

Audit Notes

• According to the audit, the district's general fund revenue increased by only 29,000 in 2000-01, an increase of 0.3 percent. Expenditures, on the other hand, increased by $217,000, or 2.5 percent. The district's payroll increased by $31,000, only 0.5 percent.

• The general fund for 2000-01 turned out $451,000 better than budgeted, the audit revealed. The district budget projections grew last year to over $1 million, but the actual deficit was half that. The district received $180,000 in revenue more than budgeted and spent $271,000 less than budgeted, creating the favorable budget variance.

• The school district's property and equipment increased in value by nearly $3,000,000 in 2000-01 (the result of work on the addition of the auditorium and fitness center that was completed by June 30, 2001). The district's property and equipment is now valued at $14,894,000.

• The district owes $9,645,600 in principal from bond issues, including $3,400,000 for the new addition.

• State payments increased by $228,000 in 2000-01, and tax revenues were down $143,000.

Contact the author at paypress@lkdllink.net • Return to News Menu

Home | Marketplace | Community