Proposed school property tax levy increases for 2006

The district levy will be the subject of a truth-in-taxation hearing in December. After that, the school board will need to approve the final levy for 2006.

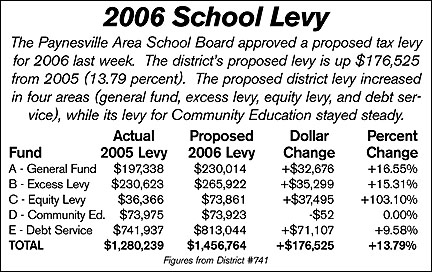

The proposed levy has increases in nearly all its funds: debt service (up $71,107); equity levy (up $37,495); excess levy ($35,299); and general fund ($32,676). The only fund to see a proposed levy decrease for 2006 is Community Education, down $52.

The district, once again, proposed levying the maximum amounts allowed by the state for 2006.

The proposed levy has increases in nearly all its funds: debt service (up $71,107); equity levy (up $37,495); excess levy ($35,299); and general fund ($32,676). The only fund to see a proposed levy decrease for 2006 is Community Education, down $52.

The district, once again, proposed levying the maximum amounts allowed by the state for 2006.

Superintendent Todd Burlingame warned the school board that the proposed levy would likely change, perhaps several times, between now and December.

The proposed levy would be the highest for the school district since 2001, when the district levied $2.23 million. In 2002, the state assumed funding for much of local property tax levies by schools, and the district levy dropped to $0.96 million.

Paynesville passed a $415-per-pupil excess levy in April 2002, raising the district's property tax levy to $1.41 million in 2003.

In 2004, the levy declined to $1.26 million, and in 2005 it increased slightly to $1.28 million.

Contact the author at editor@paynesvillepress.com • Return to News Menu

Home | Marketplace | Community