Property tax reform hits townships, cities

The Legislature passed $800 million in property tax relief in this year's extended session, which reduces Local Government Aid (LGA) and Homestead Agriculture Credit Aid (HACA) by $93 million, according to Matt Smith of the Minnesota Department of Revenue.

During the legislative session, tax reform eliminated HACA for cities, townships, housing redevelopment authorities, and watershed districts in 2002. LGA was eliminated for townships and revised for cities.

During the legislative session, tax reform eliminated HACA for cities, townships, housing redevelopment authorities, and watershed districts in 2002. LGA was eliminated for townships and revised for cities.

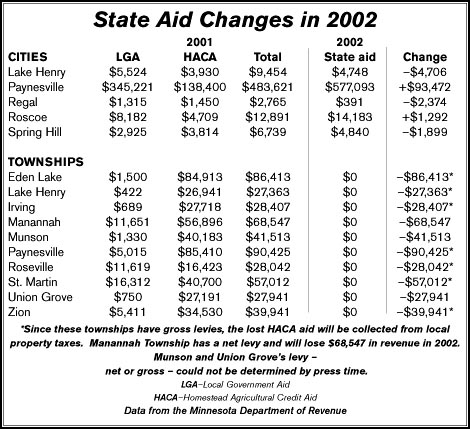

The biggest losers in aid will be area townships, which will lose all their HACA aid in 2002. For Paynesville and Eden Lake townships, this means a loss of $85,000 in state aid apiece. (See chart.)

For most townships, including Eden Lake and Paynesville, the change will result merely in a tax shift from the state to local taxpayers. Most townships pass a gross levy at their annual meeting in March. State aid is then subtracted from the gross levy to give the net levy, which is collected from local property taxes.

Paynesville Township, for example, has a gross levy of $331,000 a year. In the past, $90,000 in state aid ($5,000 in LGA and $85,000 in HACA) was subtracted and the rest ($241,000) was collected from local taxpayers.

In 2002, though, taxpayers in Paynesville Township will have to pay the entire levy. According to the Minnesota Township News- a newsletter for township governments across the state - other aspects of the property tax relief should offset this increase. That is, the reductions in the school levy should still mean a net savings for property tax payers.

This may look like a tax increase by the township on tax returns, but really is a tax shift from the state, stressed Don Pietsch, Paynesville Township chairman.

Manannah Township, though, has a net levy, which means the levy on local property tax payers is not affected by the reduction in state funds. This means the Manannah Township government will lose $68,500 in revenue next year.

Township governments have until Monday, Sept. 17, to certify their 2001 levies, which generate their funds for 2002. At least three townships in the area met to consider raising their levy.

Manannah Township was not one of them. They expect to absorb the loss in revenue next year, but may need to raise their 2002 levy.

"We're sitting pretty good as we had funds set aside for road projects that never took place. Those funds will save us this time, but we can't do it another year," said Harold Kelm, Manannah Township chairman.

Zion Township - which faces a loss of $5,411 in LGA in 2002 - has already met and decided not to raise its 2001 levy. That board, too, believes it can absorb the revenue loss in 2002.

In fact, most townships face only minimal losses in net revenue from the elimination of LGA for townships. Paynesville Township will lose $5,000, Eden Lake $1,500, and Lake Henry only $422.

St. Martin Township faces the loss of over $16,000 in LGA. They held a meeting on Tuesday, Sept. 11, to consider raising their levy.

Munson Township got $41,513 in state aid in 2001, but the Press was unable to contact township representatives and therefore its aid loss was unknown. Munson Township has scheduled a meeting to discuss its 2001 levy for Thursday, Sept. 13, at 8 p.m., at the Snow Cruiser building in Richmond.

Cities also lost HACA and had their LGA refigured. This left most cities in the Paynesville area with a loss of state aid: the city of Lake Henry (-$4,706), Regal (-$2,374), and Spring Hill (-$1,899).

Jack Kotten, Regal city clerk, found little explanation for the funding change in two letters that told the city their aid was being cut. "There was no reason given in the letters explaining our new funding level," he said.

LGA to cities was increased by $140 million, according to Smith.

Winners were the city of Paynesville (+$93,472) and Rosoce (+$1,292). The city of Paynesville went from $483,621 in state aid in 2001 to $577,093 in 2002, an increase of more than $93,000.

"We are directing dollars to urban cities with a higher tax burden," said Smith. "These communities have a high percentage of people using facilities that do not live in the community."

The Minnesota Township News indicates the full impact on townships may not be known until the property tax statements are finalized for 2002.

"I think the new tax reform will be detrimental to townships in the long run," said Carolyn Reeck, clerk for Zion Township. "At this point, no one is sure what will happen."

Jerry Roering, a tax specialist with Stearns County agreed, saying the full impact on taxpayers won't be known until tax statements are calculated for Truth in Taxation notices in November.

Contact the author at paypress@lkdllink.net • Return to News Menu

Home | Marketplace | Community