PAHCS audit confirms another strong fiscal year

PAHCS's 2005 fiscal year began on Oct. 1, 2004, and ended on Sept. 30, 2005. The audit was approved by the board of directors at a special meeting on Monday, Jan. 16. The audit was done by McGladrey & Pullen of Minneapolis.

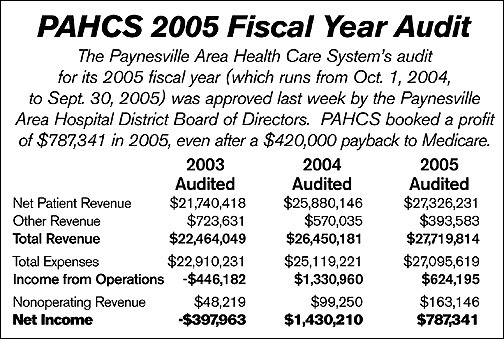

The 2005 fiscal year comes on the heels of PAHCS recording a $1.43 million profit in 2004. These years were actually more similar financially, explained chief financial officer (CFO) Kirk Johnson, as Medicare overpaid PAHCS $420,000 in 2004 which PAHCS repaid in 2005.

The 2005 fiscal year comes on the heels of PAHCS recording a $1.43 million profit in 2004. These years were actually more similar financially, explained chief financial officer (CFO) Kirk Johnson, as Medicare overpaid PAHCS $420,000 in 2004 which PAHCS repaid in 2005.

PAHCS would have had a profit of $1.01 million in 2004 and $1.21 million in 2005 if this adjustment had been made before it closed its books for 2004, insteading of repaying Medicare in 2005.

Adjustments to the Medicare cost report that PAHCS submits will be normal under the critical access hospital guidelines, said Johnson, though this payback - in PAHCS's first year as a critical access hospital - will hopefully be unique.

By switching to critical access hospital, PAHCS is reimbursed by Medicare based on its actual costs, rather than on a set rate by procedure. Since PAHCS is small by health care standards - and can include facility and equipment costs - reimbursement based on costs is much higher under critical access guidelines. Administrators have told the board that the net benefit of being a critical access hospital approaches $1 million per year. (Roughly 30 percent of PAHCS's patients are Medicare eligible.)

PAHCS recorded a profit of $787,000 in 2005 while also funding $1 million in capital purchases (equipment, etc.) and putting nearly $800,000 into its reserves (with that account now containing $1 million).

"I think we're continuing with our strategy for financial security," said CEO Steve Moburg. "Our goal is to continue to fund our reserves and invest in capital without incurring additional debt. Our financial picture improved tremendously last year, even though our gain from operations was under the previous year's."

In 2005, PAHCS had total revenues of $27.72 million and total expenses of $27.10, plus nonoperating income of $0.16 million, resulting in an overall profit of $0.78 million, or $787,000. Of that revenue, PAHCS actually billed $40 million for its services in 2005, though it received only $27.7 million after discounts to government programs and insurance companies. Of its expenses ($27.1 million), slightly over half are employee salaries and other staffing costs.

PAHCS ran deficit budgets for two years prior to 2004, resorting to a line of credit to cover its cash needs. It paid off that line of credit in 2004 and now has money in reserve.

For 2006, PAHCS has budgeted another profit of $1 million, with another $1 million going for capital purchases and $1 million going into its reserves. PAHCS opened a new clinic in Cold Spring in November and so far has been able to pay for it out of its operating cash and has not needed to utilize a loan.

PAHCS's improved financial condition was evidented by a number of statistical comparisons used in the audit. For instance, debt service coverage- a ratio that compares the income to debt payments - increased to 3.1 in 2005, meaning PAHCS's profits could have covered its debt payments three times. In 2004, this ratio was 2.1. In 2002 and 2003, when PAHCS had cash-flow difficulties, this ratio was around 1.0, meaning PAHCS needed to use all its profits to pay its debt, resulting in the necessity of that line of credit.

The median debt service coverage ratio for hospitals with 0-49 beds, according to the Minnesota Hospital and Healthcare Partnership, is 3.2. This means PAHCS is trending toward this healthy average, said Johnson, which is good news.

PAHCS still has nearly $13 million in long-term debt, which require $1 million in yearly debt service payments. This reflects recent facility remodeling projects as well as expansions such as purchasing Washburne Court and Hilltop Care Center from the Good Samaritan Society. On the flip side, PAHCS's average plant age - a measure of the newness of its facility - is lower than the state average as figured by the Minnesota Hospital and Healthcare Partnership.

PAHCS, which started as a city hospital in 1956, has never levied a local tax, rather funding expansions and facility needs through operations. Just having the district - which now includes five townships and seven cities - gives PAHCS a bigger base for borrowing, Johnson said. (Even though PAHCS pays its debt through operations, it gets a better rate since its loans are ultimately backed by possible taxation, making its loans very secure.)

Profitable operations, as well as investments in capital equipment and reserve funds, are keys to being able to make future capital purchases without taxation. Health care is increasingly driven by state-of-the-art technology, and even single pieces of equipment (such as a new CT scanner) can cost over $1 million, illustrating the need to have funds available for equipment, said Johnson.

Contact the author at editor@paynesvillepress.com • Return to News Menu

Home | Marketplace | Community