City residents face tax increase

Tax statements were mailed out in late November, based on a proposed tax levy of $483,200 for the city. This levy was later reduced to $437,300, a reduction of $45,900. This means that the tax on a $60,000 home in the city will pay approximately $30 less than the tax statement indicates. The owner of a $100,000 home should save almost $50.

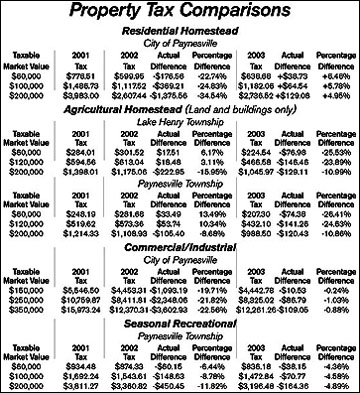

Even though property taxes will be higher in 2003 than last year, most area property owners will still have tax bills that are substantially lower than 2001. For example, in 2001 the tax for a residential homestead in Paynesville valued at $60,000 was $776.51, in 2002 the tax on a $60,000 home was $599.95, and in 2003 the tax should be $638.68.

Other than a small increase in the tax levy, (1.5 percent) there are no major changes in city taxes this year. Each year, tax statements go out before the levy is certified, and the proposed levy is the highest they can be. Frequently, the actual levy amount is lower than the proposed levy.

Other than a small increase in the tax levy, (1.5 percent) there are no major changes in city taxes this year. Each year, tax statements go out before the levy is certified, and the proposed levy is the highest they can be. Frequently, the actual levy amount is lower than the proposed levy.

The city of Paynesville proposed a higher tax levy for 2003 (in fear of cuts in state aid), but approved a smaller tax increase, resulting in these savings for property owners.

A large portion of tax increase is earmarked for the Paynesville Area Schools. A levy referendum of $415 per pupil was passed last May and will provide approximately $560,000 for the school district for the 2003-04 year. Over half of the levy, almost $283,000, should come from the state, but area property owners will be responsible for over $277,000. This accounts for approximately $62 in taxes for every $50,000 of a property's market value, said Jerry Roering of the Stearns County auditor's office.

Another portion of the increase in taxes for residential homesteads comes not from any levy increase, but from increases in property values, said Roering. According to Roering, property values throughout the area went up an average of 10 percent in 2003. Because of this increase, property owners pay taxes based on the higher value of their properties. Also, some property owners could find that they have lost part of their homestead credit, a credit reaches a maximum when a home is valued at $76,000 and is reduced thereafter.

This is a trend that is likely to continue. Currently, there is a 10 percent limit on how much the value of a property can increase in one year for tax purposes (unless there have been improvements made on the property), but the limit is being phased out and by 2008 property owners should pay tax on the full value of their properties.

From the county's standpoint, the only significant change in the property tax law this year affects agricultural property, said Roering. Ag property should see some tax decreases in 2003 due to an increase in aid. The maximum ag credit went up from $230 in 2002 to $345 in 2003. The new minimum ag credit is $230 which was the maximum credit in 2002.

For example, the tax on (Lake Henry Township) $60,000 ag property is $207.30 in 2003, down over 26 percent from last year, when the tax was $281.68.

This year, Stearns County should collect over $99,800,000 from taxpayers, said Roering. Of this, 35 percent goes to the county, 25 percent to cities, 20 percent to schools. The remainder is collected for the state, townships, and special districts.

Roering said the state tax on commercial properties and seasonal recreational properties were also reduced somewhat this year. Commercial/industrial property owners in the city should see a small decrease, in some cases less than one percent, and for seasonal recreational properties in Paynesville Township that averaged about four percent savings over last year.

Contact the author at editor@paynesvillepress.com • Return to News Menu

Home | Marketplace | Community